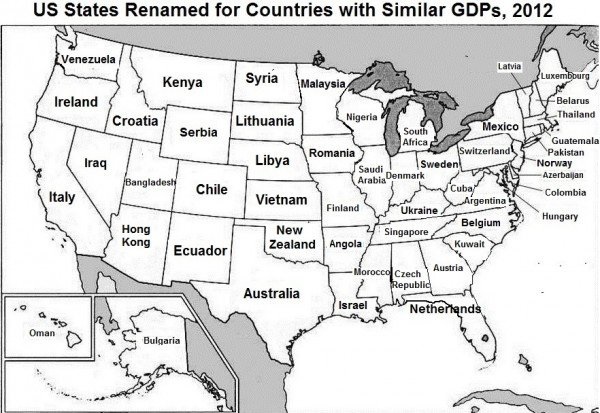

Mark J. Perry, a scholar at American Enterprise Institute, mapped the United States’s states as countries of the world. For our purpose, the focus is on 12 Muslim countries from the stated 50 states, and the challenges of fast-tracking Islamic finance in non-OIC and and GDP growth in OIC.

Source: American Enterprise Institute

Source: American Enterprise Institute

|

Country |

GDP (2012) |

State (GDP) |

Company^ |

Market Cap (2012)* |

|

Saudi Arabia |

$711 Billion |

Illinois ($695 Billion) |

Apple |

$560B

|

|

Malaysia |

$304B |

Minnesota ($294B) |

Microsoft |

$270B

|

|

Nigeria |

$262B |

Wisconsin ($261B) |

Microsoft |

$270B

|

|

Pakistan |

$215B |

Connecticut ($229B) |

GE |

$212B |

|

Kuwait |

$183B |

South Carolina ($176B) |

AT&T |

$185B |

|

Iraq |

$149B |

Nevada ($133B) |

Oracle |

$145B

|

|

Bangladesh |

$127B |

Utah ($130B) |

Merck |

$116B |

|

Morocco |

$95B |

Mississippi ($101B) |

Abbott |

$96B

|

|

Libya |

$95B |

Nebraska ($99B) |

Abbott |

$96B |

|

Oman |

$78B |

Hawaii ($72B) |

Walt Disney |

$78B

|

|

Azerbaijan |

$68B |

Delaware ($65B) |

Caterpillar |

$68B

|

|

Syria |

$46B |

N. Dakota ($46B) |

Comcast |

$62B |

^ S&P 500 100 Largest Companies Ranked by Market Cap.

*March 30, 2012.

Dr. Perry stated, “...Overall, the US [at $16 Trillion GDP] produced 22.3% of world GDP in 2012, with only 4.4% of the world’s population. Three of America’s states (California, Texas and New York) – as separate countries – would rank in the world’s top 15 largest economies. And one of those states – California – produced more than $2 trillion in economic output in 2012 – and the other two (Texas and New York) produced more than $1 trillion of GDP in 2012...”

In other words, the talk of US decline is premature, if not wrong, and the guesstimates associated with QE speaks volumes of US reach and influence, notwithstanding S&P downgrading its Triple A rating. The US has recognised that it must continually reinvent itself, from technology to energy, to continue to lead the world in almost every relevant category that impacts and influences business, commerce, trade, innovation, finance and capital markets.

A future article will map the GDP of the 57 OIC countries to the market capitalisation of publicly listed companies in the Muslim world. But, are the largest companies in the Muslim world publicly listed, privately held or state-owned enterprises? Can it be said that the median GDP of the 57 countries is a large capitalised western company? Based upon Dr Perry’s above research, I would expect the GDP of countries to be much higher than the market capitalisation of OIC based companies, and there are implications.

Fast-tracking Islamic finance

A number of enlightened, non-Muslim countries have overcome irrational fear of Islamic finance, like UK, Singapore, Hong Kong, Luxembourg, Bermuda, etc. They want to tap the petro-liquidity by (1) planting the flag of “Islamic finance hub” and (2) establishing a level playing field regulatory and tax infrastructure. For example, the UK has been in the Islamic finance space since the 1980s, and, only in 2013, Prime Minister David Cameron declared, during the 9th World Islamic Economic Forum in London, that it will issue a 200 Million GBP sovereign Sukuk.

Furthermore, Baroness Warsi, Senior Minister of State and Minister for Faith and Communities, and the Ministerial lead on Islamic Finance, who launched UK’s first Islamic Finance Task Force in 2013, and chairs the Global Islamic Finance & Investment Group, recently said “… the skyline of London is being changed by Islamic finance...an Islamic finance market that doesn’t sleep... We need to make sure that all time zones are trading in terms of Islamic finance products.”

She went on to say, “...As a Muslim, I believe in the principles of Islamic finance. As a Conservative, I can see the huge economic benefits of Islamic finance and as somebody who feels that Britain’s best days are still ahead of us, I feel that Islamic finance provides another opportunity to reach out to the world and bring the benefits of that for our citizens.”

However, other countries have not reached the stage where the country leader and cabinet minister, working with years of Islamic finance on their shores, endorses Islamic finance as part of their global financial hub offering. So, fast tracking Islamic finance is a challenge!

Is fast tracking GDP development in OIC also a challenge?

Lessons for OIC

The first lesson about the US is simply “size matters”, be it the GDP, stock market capitalisation, or private sector employment and (equity) ownership opportunities! But, the question becomes how does a Muslim country obtain respectable size on fast track basis with minimal impact from the expected law of unintended consequences?

Is it just a matter of moving away (by decree or bill) from the low value added apparel, agriculture and manufacturing economic sectors to the service and technology sectors? Follow up question is there an enabling infrastructure of visionary leadership, education culture, human capital development and capital markets to move up the value chain?

In places like US, its well accepted net job growth comes from start-ups [and SMEs with access to capital], which implies enabling “hard asset infrastructure” of angel investing, VC, mentoring/incubation, linking with research universities, and Nasdaq type exchange. There is also the [more important] soft asset culture of encouraging free-flow of “ambiance inter-activity” on, say, spur of the moment!

Former US President Ronald Regan, said, “...Entrepreneurs and their small enterprises are responsible for almost all the economic growth in the United States.”

Thus, outsourcing money to VC firms in Silicon Valley, with hope of transferring technology- reverse linkage- is not going to be effective, as the home country is not establishing ‘start ups’ and net job growth.

[Enticing diasporas to return, like in India, China, etc., with their experience, knowledge, capital, connections, etc., is an article for another day.]

G20 value chain

It is well known Turkey, Indonesia and Saudi Arabia are part of the elite group of ‘G-20 countries,’ but are there upcoming Muslim countries, with 2020 vision, that can become part of the club? The runner ups to number 16 Indonesia (World Bank, 2012, GDP of $878 Billion), number 17 Turkey ($789B) and number 19 Saudi Arabia ($711B) are (a) number 22 Iran at $514B, (b) number 32 UAE at $348B, and (c) number 34 Malaysia at $303B. It’s interesting to note that Malaysia is a short distance, through number 33 Denmark at $314B, to the UAE, led by global brand Dubai and petroleum heavy weight Abu Dhabi

Conclusion

Muslim countries need an enabling infrastructure the naturally facilitates economic growth, development and diversification, and it won’t be not be based on “hedge fund holding time period”.

The example of UK becoming an Islamic finance hub has lessons for Muslim countries wanting to achieve “shock absorbing size that matters”.

But, “Economic growth doesn't mean anything if it leaves people out”, said Jack Kemp. – February 18, 2014.

* This is the personal opinion of the writer or publication and does not necessarily represent the views of The Malaysian Insider.

Comments

Please refrain from nicknames or comments of a racist, sexist, personal, vulgar or derogatory nature, or you may risk being blocked from commenting in our website. We encourage commenters to use their real names as their username. As comments are moderated, they may not appear immediately or even on the same day you posted them. We also reserve the right to delete off-topic comments